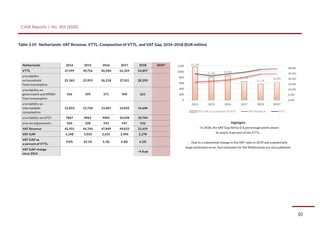

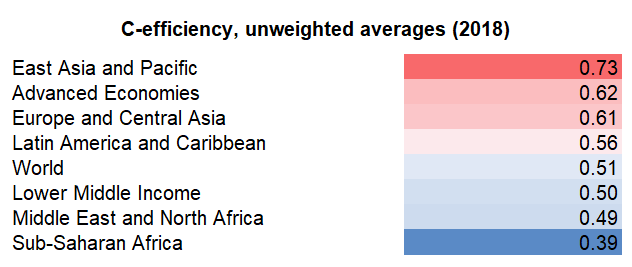

The Revenue Administration—Gap Analysis Program: Model and Methodology for Value-Added Tax Gap Estimation

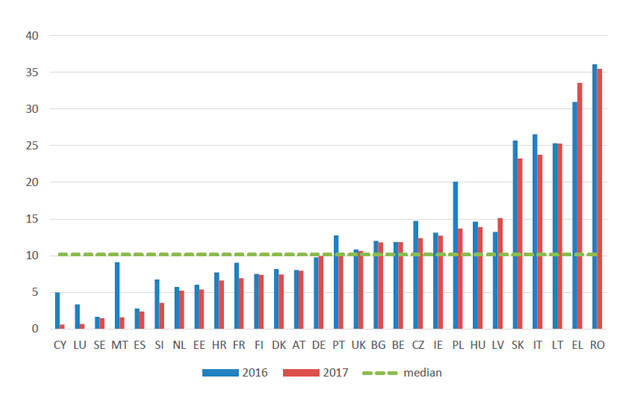

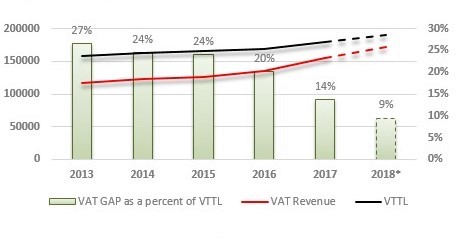

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research